Why RUC?

Charging by the mile, rather than by the gallon of gas or an annual vehicle registration fee, harmonizes transportation funding with climate policy objectives and efforts to bring greater equity to transportation taxation. RUC preserves the user-pay, user-benefit funding approach, giving all drivers a way to contribute based upon how much we use the roads.

The gas tax is dedicated to fund our roads and bridges under the state constitution

The construction and maintenance of highways is currently funded through a state gas tax of 55.4 cents per gallon as of July 1, 2025, increasing by two percent annually thereafter.

Washington state requires that all light-duty cars and trucks meet zero emissions standards by 2035

As more of the cars on our roads are electric or more fuel-efficient, funding from the gas tax is expected to decline. In order to generate current levels of revenue, the gas tax would need to increase by 1.7 cents per gallon, per year between now and 2040. This would result in the gas tax reaching $1 per gallon by 2040.

RUC 101

Check out the video below to learn more about what RUC is and how it could work for Washington.

RUC 101

Why RUC?

Why RUC?- RUC preserves the fairness that the gas tax once embodied: only pay for the miles you drive regardless of your vehicle type

- RUC is built for a sustainable future by helping fund our critical infrastructure while we transition away from fossil fuels for transportation

- RUC is a reliable funding source for necessary road maintenance and upkeep over the long-term

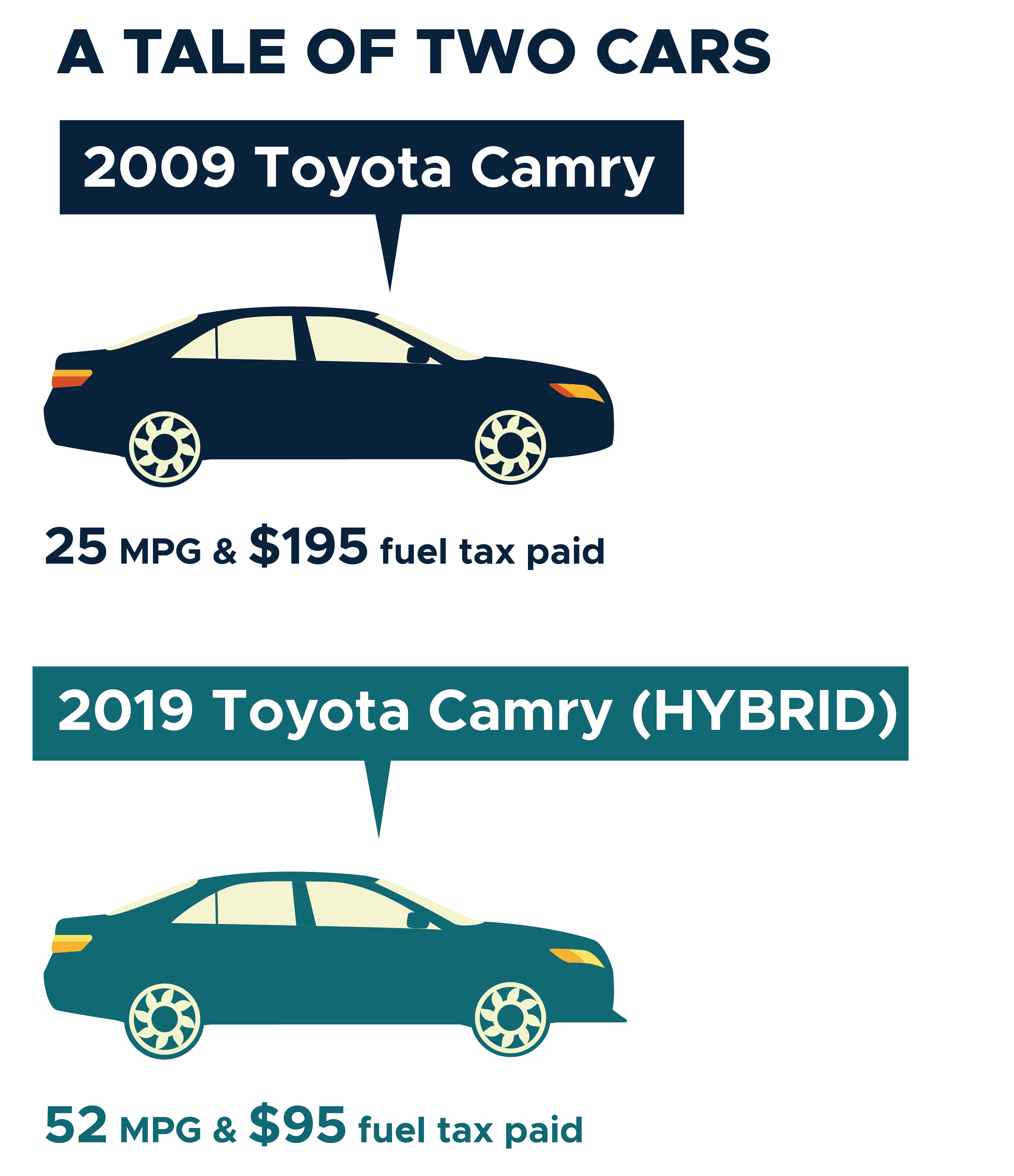

A RUC re-establishes fairness in how to fund our roads

When the gas tax was created decades ago it was based upon a simple principle of user pays, user benefits. However, as cars become more fuel efficient and don’t use gas, the gas tax has become a some users pay, all users benefit model.

RUC returns us to the user pays, user benefits principle.

based on 10,000 miles driven

based on 10,000 miles driven

RUC HARMONIZES CLIMATE & ROAD FUNDING POLICIES

Under the current gas tax, Washington state depends on the continued consumption of fossil fuels to fund our roads. RUC would provide funding for critical transportation infrastructure without the dependency on fossil fuels by replacing a tax based on the number of gallons of gas consumed with one based on the number of miles driven.

As a means of furthering Washington state’s environmental goals, RUC can also help incentivize a transition to high-efficiency and electric vehicles by offering it as an alternative to the EV and hybrid flat fees ($225 and $75 respectively), and/or with a reduced introductory per-mile rate.

Transportation funding and climate policy objectives:

User-based charges and taxes are a significant part of our state’s current transportation funding. In Washington, motor vehicle fuel taxes comprise 52% of all transportation revenues. Licenses, permits, and fee revenues comprise the second largest share at 27%.

Learn more about state transportation revenue at the Washington State Office of Financial Management.

State and federal vehicle fuel taxes comprise over half of our state transportation revenue and are collected at the pump – a combined $0.678-$0.738 per gallon, depending on the fuel type. Of that per gallon tax, $0.494 cents goes to the state, with the remainder going to the federal government. Washington’s gas tax was last raised in 2016. The federal gas tax was last raised in 1993.

Learn more about current motor vehicle fuel tax rates and administration at the Washington State Department of Revenue.

Vehicle registration, licensing, plate and other fees provide over a quarter of the state’s funding of our transportation system.

Learn more about various vehicle registration fees at the Washington State Department of Licensing.

Transportation is the largest source of greenhouse gas emissons in Washington. In 2020, the Washington State Legislature set new greenhouse gas emission limits to combat climate change. Under the law, the state is required to reduce emission levels to 95% below 1990 levels and achieve net zero emissions by 2050.

Washington State aims to reduce greenhouse gas emissions by 1 million metric tons of carbon dioxide by 2030. This includes increasing the number of zero emission vehicles on Washington’s roads. Under current policies, by 2035 all new vehicles sold in the state must be plug-in hybrid electric vehicles (PHEV) or zero emission vehicles (ZEV).

If no other actions are taken to replace road funding from fuel taxes, this means that by 2035, the state is anticipated to see a potential 45% reduction in gas tax revenues which currently fund essential road, bridge and ferry needs.

Although the new rule sets a 2035 deadline for meeting ZEV criteria, Washington is working to make the switch even faster – laws enacted in 2021 set a goal to move away from fossil fuel vehicle sales by 2030.

Learn more about the state’s work to curb greenhouse gases and clean car standards at the Washington State Department of Ecology.

In 2022, the Washington State Legislature passed the Climate Commitment Act to curb greenhouse gas emissions. This law, which goes into effect January 2023, establishes a cap on greenhouse gas emissions in the state, which is maintained by the distribution and auctioning of allowances to achieve the greenhouse gas limits set in state law. In addition, the state’s Clean Fuel Standard requires suppliers to reduce the carbon intensity of transportation fuels, which will cut statewide greenhouse gas emissions by 4.3 million metric tons a year by 2038 and will stimulate economic development in low carbon fuel production.

Learn more about the state’s cap and invest system and clean fuel standard at the Washington State Department of Ecology.

Washington State offers refunds on sales tax for purchases of qualifying new and used clean alternative fueled vehicles, or plug-in hybrid vehicles, as well as sales tax exemptions for purchases or installation of related infrastructure.

Learn more about electric vehicles and other green vehicle purchase incentives at the Washington State Department of Revenue.