FAQs

A road usage charge is a per-mile charge drivers could pay based on how much they use Washington’s road system rather than pay by the gallons of gas they buy.

A RUC can help ensure sustainable, long-term funding. As more vehicles on Washington’s roads get better gas mileage, or don’t use gas at all, gas tax revenues are projected to decline. Washington state aims to ban gas-powered cars by 2030, and under current regulations by 2035, all new vehicles must be plug-in hybrid electric vehicles (PHEV) or zero emission vehicles (ZEV). By 2035, the state is anticipated to see a potential 45% reduction in essential road, bridge and ferry maintenance revenue currently funded by the gas tax (see graph below). A RUC also helps ensure everyone pays for the miles they drive, rather than how much gas is purchased. Drivers of older and less fuel-efficient vehicles pay more in gas tax than newer and high fuel-efficient vehicles.

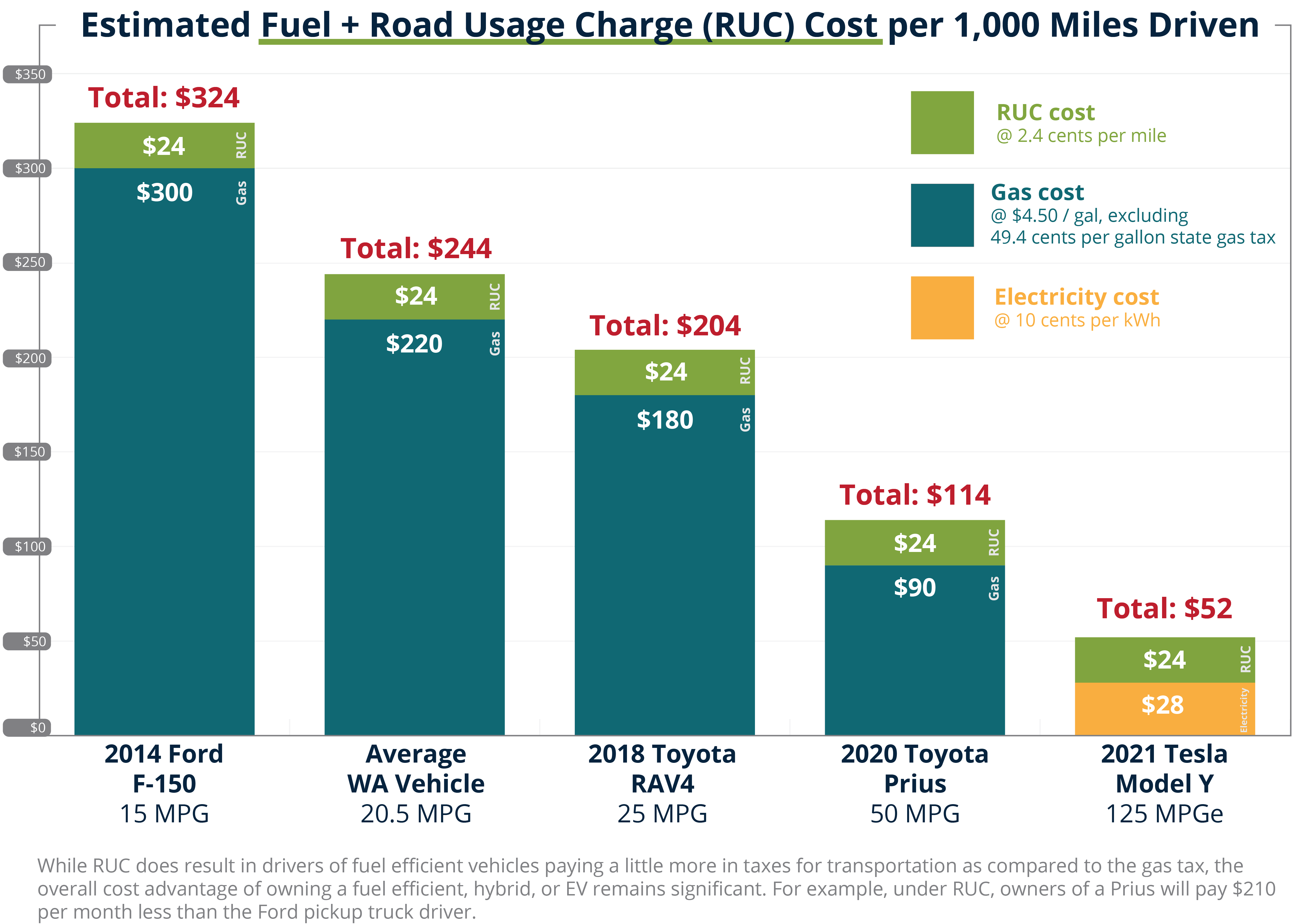

See the graph in the below FAQ that shows estimates for the cost of fuel and RUC for a variety of vehicles on Washington’s roads.

No, the road usage charge is being considered as a replacement to the gas tax and electric and hybrid vehicle fees, not on top of or in addition to the gas tax and EV and hybrid fees. In Washington, a transition to a road usage charge would be gradual – more like a dial than a switch. During this gradual transition, no drivers would be taxed twice – they would only pay either a RUC or the gas tax and hybrid surcharges. In the case of EVs, drivers would pay either RUC or the annual surcharge.

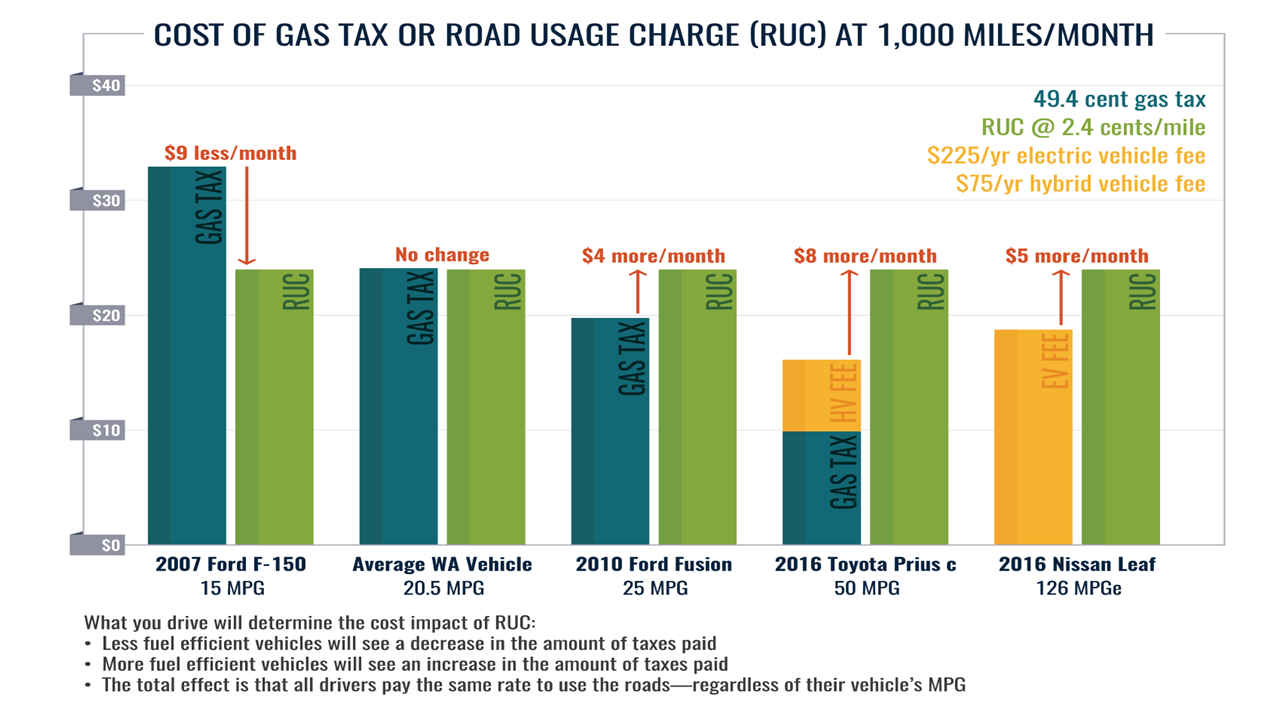

In a potential RUC system, the Legislature will set the RUC rate. They would likely set a rate equivalent to today’s gas tax, based on a car that gets an average vehicle fuel efficiency of 21 mpg. This rate is 2.4 cents per mile, or approximately $24 per 1,000 miles driven.

For an average Washington vehicle that travels 12,000 miles annually, this is about $288 in RUC fees. This compares to about $289 an average fuel-efficiency vehicle pays yearly in gas tax.

Actual RUC fees would vary by vehicle type:

- Less fuel-efficient vehicles would pay less in a RUC system.

- More fuel-efficient vehicles would pay more in a RUC system.

In a RUC system, all drivers would pay the same rate to use the roads – regardless of their vehicle’s fuel efficiency.

While RUC would mean drivers of EVs and other highly fuel-efficient vehicles pay a little more in a RUC system compared to the gas tax, the overall cost advantage of owning an EVs, hybrid, or other fuel-efficient vehicle remains significant. For example, under RUC, owners of a Prius will pay $210 dollars per month less than the Ford pickup truck driver. A RUC system would also likely replace the current flat annual fees for hybrids and EVs.

Two studies have looked at Washington state and the Western U.S., and examined whether a potential transition from the gas tax to a RUC would disproportionately affect rural households.

Some key findings:

- Rural residents tend to drive less fuel-efficient vehicles, which increases the amount of gas taxes they pay.

- Rural drivers tend to travel longer distances per trip, but also tend to make less frequent trips than urban drivers.

- In Washington, rural households are estimated to pay 4.8% less under a RUC system, and urban households are estimated to pay 1.0% more in transportation taxes under a RUC system compared with the current gas tax.

In a potential RUC system, nothing would change when you travel out of state as long as the gas tax continues to be collected. The same is true for visitors coming to Washington state. Drivers would be able to fill up and pay the gas tax that goes to support the roads.

Yes. Washington has tested multiple options for recording RUC mileage that do not rely on collecting location-based or GPS technology. Viable approaches include:

- A mileage permit where drivers can pre-pay for a block of miles.

- An odometer reading where drivers would report their odometer at the time of their vehicle’s registration renewal.

- A plug-in device or a smartphone app that does not use GPS, essentially resulting in the total miles driven being collected and sent in via an automated system.

This would be up to the Legislature to decide. Currently, highways are designed to support heavy vehicles over 30,000 pounds, and these heavy vehicles currently pay hefty weight fees to compensate for their impact. Given this, a RUC rate based on weight is not necessary.

RUC harmonizes transportation funding needs with our state’s climate policy objectives by ensuring that Washington can maintain and preserve funding for roads, bridges, and infrastructure, without depending on taxes from fossil fuels.

Washington’s gas tax was last raised in 2016 to 49.4 cents per gallon. In 2022, Washington passed the Climate Commitment Act to curb carbon emissions establishes a comprehensive, market-based program to reduce carbon pollution and achieve the greenhouse gas limits set in state law. This law went into effect in January 2023 and does not raise the current gas tax.

A chart from a June 2022 memo by the Washington Research Council, a free-market policy nonprofit, showed that the Climate Commitment Act cap-and-invest program could result in an increase in compliance costs of 46.6 cents per gallon in 2023. However, the chart itself states that the data should not be used to forecast fuel prices. Despite this disclaimer, the 46-cent figure has been repeated by other groups. It has sometimes been incorrectly cited as an official Department of Ecology estimate. This figure does not reflect Ecology’s analysis and it appears to be based on narrow, oversimplified assumptions.

Ecology’s analysis predicts minimal price impacts to the price of gas in 2023 and very modest impacts in future years. These are not “best case” outcomes. The impacts remain small when we evaluated them under a range of potential market scenarios. Learn more about the Climate Commitment Act.